Auckland, New Zealand – 19 January 2023

Marvin Yee, Partner @ Crown Private & Crown Capital

For many of us, 2022 was and 2023 will be a year of consolidation. There are still deals to be found but it is Marvin’s belief that such opportunities will fall into only two types of deals at least for the next 12 months.

May you live in interesting times – This is a recurring theme for me when I look back to 2022.

The common phrase most likely originates from a traditional Chinese curse. The receiver thinks that they are being offered a blessing, when in reality, the intent is irony – perhaps it would be better to live in uninteresting times?

For many of us, 2022 began with a lot of optimism. Covid was breathing its last breath.

Regular travel was once again on the horizon with ever decreasing restrictions being announced almost daily. Wherever we went there was a sense of cautious – if not vigorous – optimism. Most of us wanted to get back to business and recover the momentum that was lost over the previous 2.5 years.

That optimism started to fade as the year progressed. Tales of recession and rising interest rates occupied our conversations. Crypto had fallen (yet again). Equities that seemed full of potential appeared overpriced and were tanking.

The West’s withdrawal from Afghanistan appeared to empower those who wanted to upset the old world order. War in Ukraine, energy crisis and finally the combat of ideologies surrounding Covid only served to entrench.

How did it go so wrong? Where did it start? And finally, how can we benefit from this state of affairs?

I recall during the Trump presidency, the economy never seemed so good. Equities were at an all-time high – with no ceiling in sight. The US was riding an economic high.

This was largely due to the maturity of the 10-year U.S Treasury Bond which is primarily responsible for the dominance of the US dollar in international trade.

The high should have ended there, but the end of the Trump presidency was also the beginning of Covid which effectively suspended large parts of industry.

Subsequent public handouts which would normally serve to stimulate a stalled economy were instead handed out to keep the populace at home – and not working – and to reinforce the lockdown agenda.

The impact of this relatively cheap money was significant spending instead of what should normally have resulted in prudence during a recession.

Equity prices continued to soar, albeit artificially. While we had all expected a recession, this did not eventuate until nearly a year after significant restrictions had been lifted.

Arguably the justification for utilizing public funds for pandemic relief became more untenable.

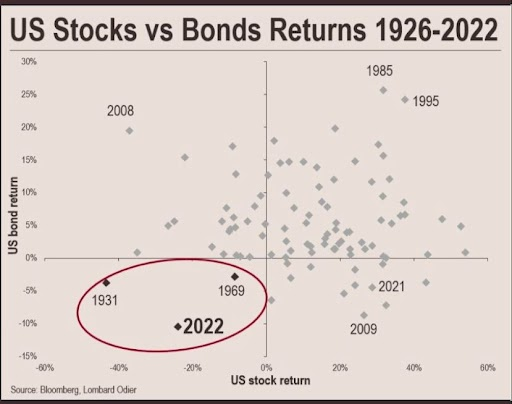

2022 was bad for most people. This chart courtesy of my friend Briton Hill, shows that for the third time in US stock market history, both stock and bonds were underwater.

For many of us, 2022 was and 2023 will be a year of consolidation. There are still gems to be found but it is my belief that such opportunities will fall into only two types of deals at least for the next 12 months:

- Undervalued equities – now is the time to only do deals if you can steal it. That’s looking for bargains and bargaining hard.

- Short term secured debt – it is quite hard to overstate just how important is this strategy. High interest rates exert pressure on equities, so companies rely heavily on short term debt to bridge their growth requirements while waiting for equities to become attractive again without compromising their valuation.

In 2021, Obris had a record performance for equity investments, largely led by our Coinbase IPO that produced a c.186X return.

The clear 2022 winner in terms of return was our High Yield Debt Fund that provides short-term commercial lending. The counter cyclical nature of this investment meant that in times of recession, there is greater demand for this product as banks have tended to retreat from commercial lending.

We also managed several exits last year with Nextseed via a trade sale, Stabilitas via a trade sale, Cooks Global Foods convertible note settlement and Natural Source Group via a NASDAQ listing (of which we are still under escrow).

There are a couple of notable companies to keep a keen eye on. We see good things happening with Manuka Biosciences and Sanguine Biosciences, two companies in which Obris has invested in multiple funding rounds.

Manuka Biosciences has just concluded what looks to be its last funding round before a full or partial liquidity event. They are in the process of expanding into Australia with a strategic partner. The directors believe it to be highly likely for an ASX (Australian Stock Exchange) listing towards the end of 2023 or early 2024.

Sanguine Biosciences has also completed a significant funding round with a venture firm at a $100M valuation. This company was able to make significant progress during Covid. Their employee headcount is now more than 100 and we are expecting a liquidity event by or about 2024.

The nature of successful deals which will do well in these bear market times will be those which are curated from the start to have significant upside while protecting downside risk.

Granted, this is our goal with every Obris deal irrespective of market conditions.

The recent deal we completed with Accent Solar Technologies, Inc. (ASTI) is one such example. We curated a deal to participate in a PIPE (private investment in a public equity) where we had a sliding put option exercisable in 6, 12 or 18 months with an unlimited upside.

If the share value is worth more than the put, we will sell the shares on the open market. Conversely if the put is worth more, we will exercise the put. Either way, investors make a good profit. It is purely a matter of the quantum of upside.

We will do more of these types of deals in 2023.

After all, we don’t subscribe to a ‘spray and pray’ investment strategy. We will likely be doing fewer deals but ones with much more certain outcomes.

Final Thoughts

As a strategy this year, don’t underestimate strategic inaction. A wait and see approach is prudent in a market that’s losing value.

2023 is the time to consolidate your holdings, participate in short term secured debt and only look at equities that are a steal.

There will be bargains galore in the coming months.

Outside of the debt and equities opportunities I mentioned, I am also watching the real estate market with interest.

63% of Westpac Bank’s loan book comes from fixed interest loans that will convert to variable rate loans in August; many people will see their interest payments double. Similarly in Australia 67% of interest only loan agreements will expire in August 2023.

In other words, it’s a good time to be cashed up.

Sincerely,

Marvin Yee