James Evenson

Auckland, 13 August 2024

You may be wondering why the Global Investor has been missing in your inbox for the past several weeks. We took a break from writing after our April Meet Up in Auckland. We are back, focused and ready to educate and explore.

As a reminder, the Global Investor is Obris’ complimentary newsletter. Our goal is to provide readers with thought provoking content that will lead you to invest well – to help your money work for you as you grow your wealth. We also utilize the Global Investor to illuminate our core principles of People, Places & Deals.

Obris was created to bring together accomplished professionals to pursue wealth creation, experience a community of like-minded successful people, and make their hard-earned wealth work harder.

We presented a 2024 Global Market Overview at the Auckland event – with a focus on the countries on our radar. We also shared the tools we use to evaluate countries and markets, and ultimately where we choose to invest.

This issue of the Global Investor follows that same theme. Please sit back and enjoy.

Interested in learning more about Obris, our events or our investments? Please contact us at investors@crownprivate.com.

Investing Globally

Marvin and I embrace portfolio diversification from two distinct mindsets. First, as any astute investor knows, don’t put all your eggs in one basket.

Diversifying your investments allows you to mitigate volatilities created by political changes, recession, inflation, high interest rates and commodity cycles.

While avoiding such volatilities is the easiest way to avoid risk, understanding and leveraging volatilities in our favor can serve us well.

Most important, the world is full of entrepreneurs, emerging economies and even established companies in established markets from which we can make significant gains.

J.P. Morgan stated it succinctly, “Investing globally can improve your portfolio’s return: Investing globally offers the potential for better returns when compared to the returns of real local assets.” This is most likely true no matter where you call home.

If you want to delve further into a case for investment diversification, I recommend watching our podcast interview from a few years ago with Kim Iskyan. Kim is a good friend of mine and the publisher and CEO of Porter Stansberry’s Porter & Company. You may access the interview here. Kim also gave a great presentation at our Miami Investor Meet Up, which you will find here. The password is Obris2024!

Developing a Lens

Whether you travel close to home or venture across the world it is crucial that you develop a lens to identify opportunities, or even attributes that may suggest that opportunities may be found.

I spend about half of a given year traveling to a variety of countries across the globe. As I walk and explore, eat in restaurants, stay in hotels and ask a lot of question of the people I encounter, I assess their attitudes, how genuinely happy are people and what is the level of entrepreneurship that is demonstrated.

I also consider how innovation is demonstrated and what creative businesses already exist that are crucial to a developing market.

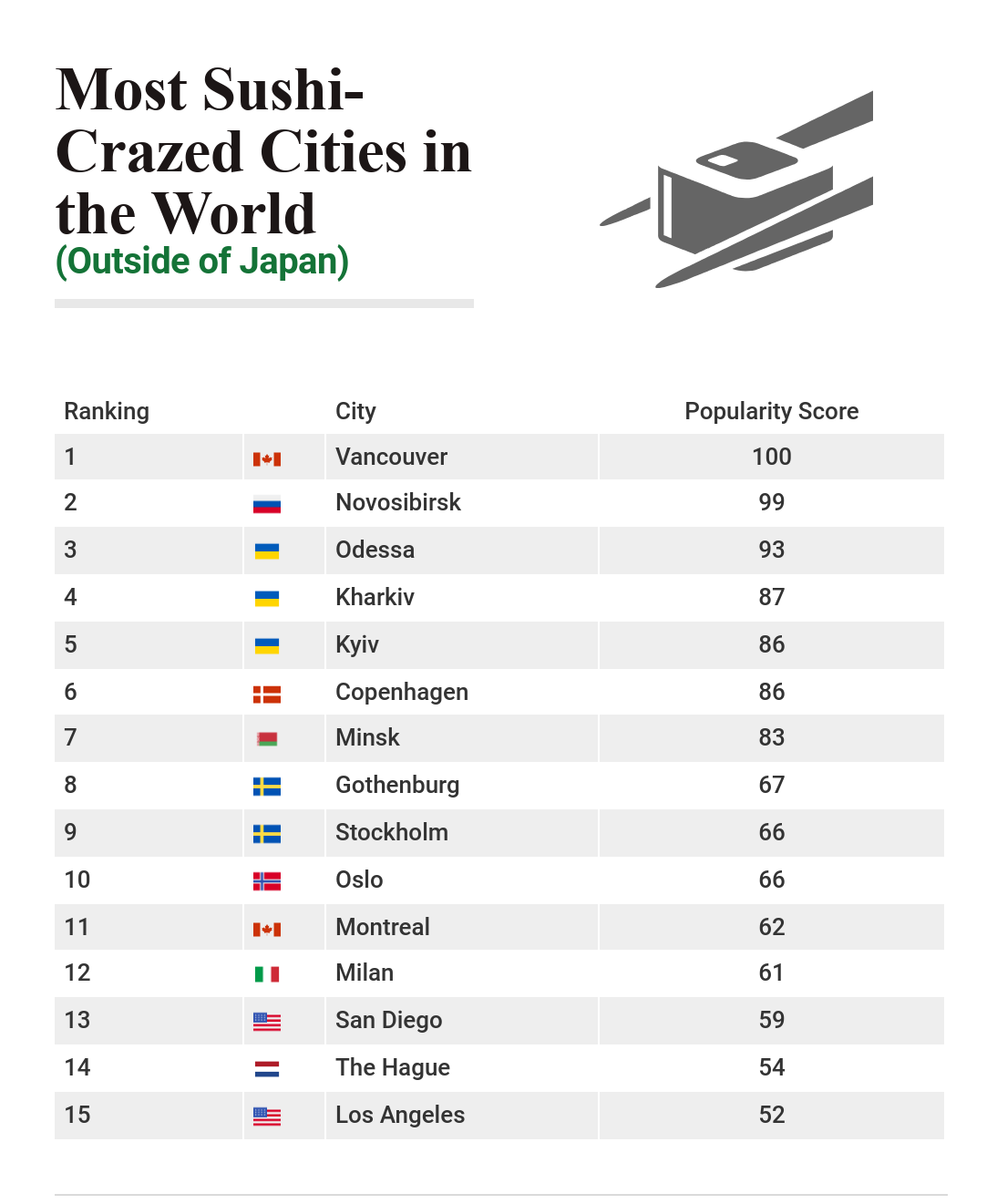

In a conversation several years ago, Kim told me that a first indicator to him that a market is developing is the proliferation of Sushi restaurants.

Think about it.

I remember when the first Japanese restaurants opened in Moscow, Kiev and even Prague. People queued up for more than an hour to get a seat. If the first is successful, there will be more, many more. That was the case.

What do you look for when you visit countries that are new to you?

Tools for Evaluating Global Markets

Before you invest in a Japanese restaurant in Mongolia, let’s look at proper tools to evaluate markets.

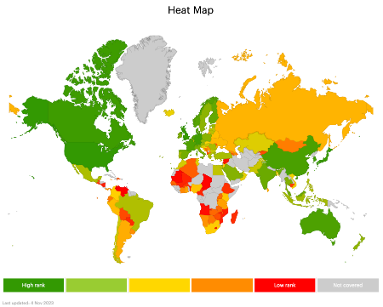

The IESE Business School of Navarra in Barcelona established the Venture Capital & Private Equity Country Attractive Index several years ago. The report is updated annually.

I particularly like their “Heat Map” – an interactive Country Attractiveness Map, as you may see below. Highlight a country and you will see its Attractiveness score. Click on the country and you will be directed to a unique page that explains the basis for rank and score. Follow this link to check it out for yourself.

The IESE evaluates countries and bases its ranking on six key factors. These include market regulations, strong rule of law to protect property rights and contracts, sophisticated infrastructure, start-up scene and entrepreneurship, access to capital and the availability of a skilled workforce.

Not to disparage their assessment in any way, as one may expect, IESE’s top ten countries are all established markets.

India is the first emerging market on the list, ranked at number 18 and with a score of 74.2. The Philippines – the fastest growing economy in Asia –is #40. Bright star frontier market Uzbekistan does not even make the cut.

The criteria set by IESE are extremely valuable, particularly for evaluating established markets like those identified in their top 10.

We invest in many of the high ranking markets, particularly in private equity where we can control the narrative to ensure outsized returns within a five year window.

Unfortunately, though, many of the most promising markets in the world today are overlooked, or rather disqualified by IESE’s evaluative tools. The potential for outsized returns is far greater when you expand your evaluative criteria.

When I walk down the street and engage entrepreneurs and innovators in Manila, Ho Chi Minh, Almaty, Tbilisi, Tashkent and Delhi, I see ample opportunities. To consider such markets though, we have to expand our criteria for deciding what are acceptable markets.

The Obris Lens

At Obris, we enhance IESE’s criteria with our own set of key considerations. Our goal is not to tick every box, but rather to evaluate a given market or project as thoroughly as possible, weighting each unique criteria to create the potential for significant returns while limiting risk.

Our first consideration is obvious – we strive – as we always have – to find potential for asymmetrical returns where others are not looking. This is in the DNA of Obris.

We also look for vibrant economic activity. This goes hand in hand with demonstrations of entrepreneurship, innovation and zest for life that I reference earlier in this article.

You may recall that I visited Georgetown, Ghana a few months ago with Cody Shirk of Explorer Partnership. We met with several companies that are seeking foreign investment.

At each meeting with company founders, I found myself asking the same question, how do foreign investors protect their investment – how do we ensure that our investment is protected, and that we can control the narrative.

A key aspect of investor protection is the prevalence of property rights, particularly international property rights as we are uncomfortable doing anything where we need to rely on a local nominee.

Assessment of risk is equally crucial. Anyone who invests with Obris knows that we strive to limit risk. Marvin, my business partner of nearly a decade, is a master at identifying strategic ways to minimize risk in investments; I think he lives for this. We do not want to lose money; we don’t want our investors to lose money.

We also consider the geography of the various structures in regard to tax. Colombia for example imposes a 35% capital gains tax irrespective of whether you have a capital gain – if you sell the business the entire investment including the sunk cost is taxed.

This does not automatically preclude investing in a country with an unfavorable tax structure. In a case like Colombia this we will use Panamanian entities for the transaction.

We also like utilizing Singapore companies with New Zealand PIE structures as beneficial owners. This allows for the creation of a stable security between income and capital gains tax. Marvin will explain this in greater detail in a future Global Investor newsletter.

Lastly, we want liquidity – not in 1-3 years, but rather 3-5 years. I am dismayed by how many CEOs and founders have no concept of an exit. This is always one of my first questions when evaluating a company – one that disqualifies most of the companies in which I consider investing. You must know what you want, and if an imminent exit – with outsized returns – is not on the 3-5 year horizon, we are not interested.

It All Boils Down To…

Utilizing the Obris evaluative lens, we consider established, emerging and frontier markets.

So far this year, we have invested in two established companies – the digital brokerage, Sharesies – from which we expect to IPO soon, and Sealegs Amphibious Vehicles, a PE move where we are acquiring 20% of the company with the aim to exit with a solid multiple in the next five years. Both are in an established market, #19 on IESE’s Heat Map – New Zealand.

We are also evaluating several new markets for investment. We will dig into each of these over the coming months to share with you in the Global Investor.

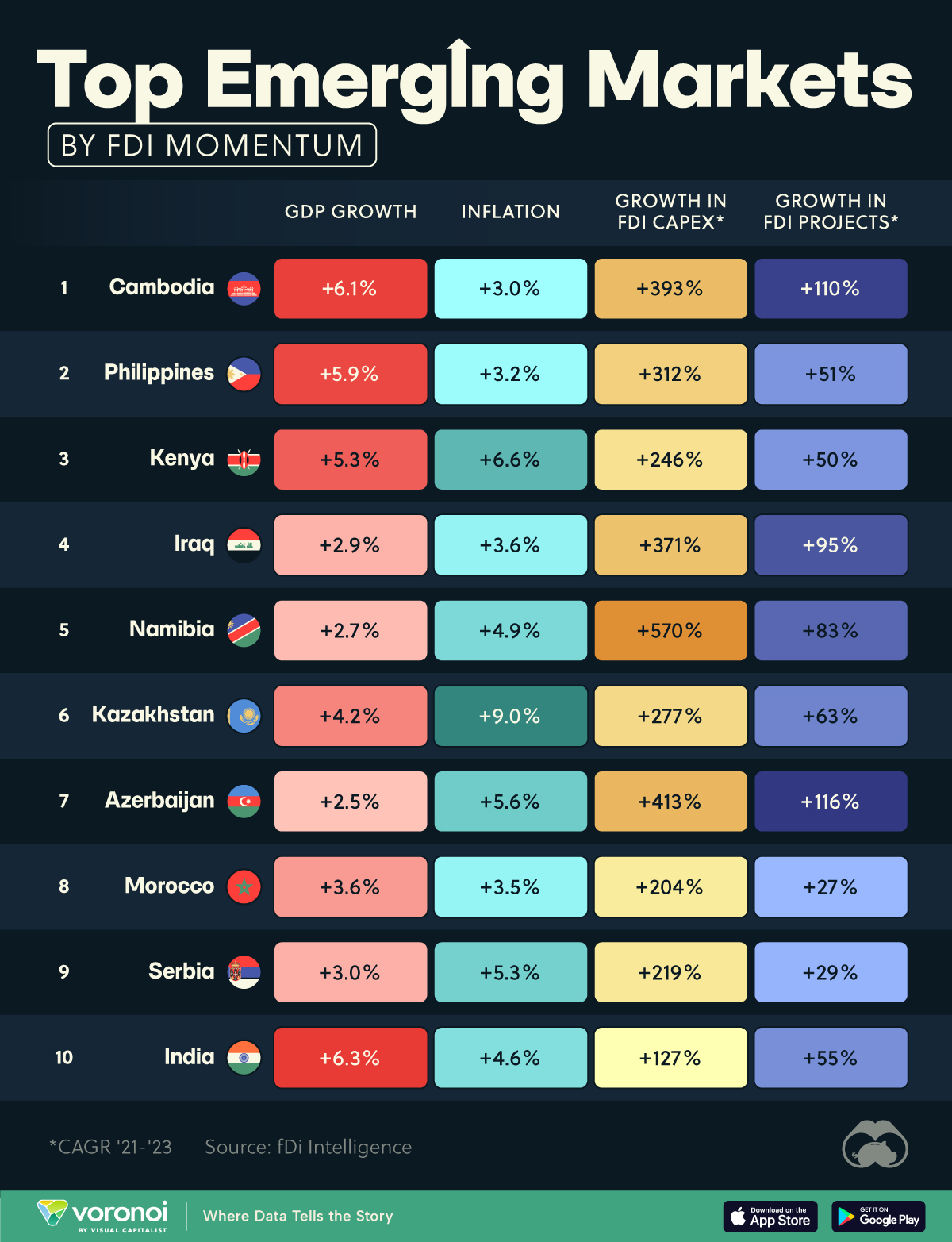

SE Asia’s fastest growing economy will be our first expose, #2 on the “Top Emerging Markets” image by FDI Momentum.

I am a frequent visitor of the Philippines. The vibrancy of people, the demonstration of entrepreneurship, and the high level of education among the populace of 119M people make this often-overlooked emerging economy a prospect for investment.

There are also ample factors that may cause potential investors to pause and evaluate.

The Philippines has been on Obris’ radar for several years. I (James) have been traveling to The Philippines regularly for the past decade, and Marvin has made several investment exploration trips as well.

We have also carried out due diligence on several promising companies dating back to 2016. While we have yet to take on any significant investments, we believe that this is the right time to gather, explore and invest.

Not to get ahead of ourselves… We will save our evaluation for next week. In the meantime, mark your calendar. You will not want to miss our Investor Meet Up in Manila and Boracay.

We look forward to demonstrating our tools for assessing potential markets over the coming months with you.

Sincerely,

James