Auckland, New Zealand – 24 February 2022

In this issue of the Global Investor, Marvin Yee assesses the global economic environment as we emerge from the pandemic, and most importantly, investment sectors that are poised to do well this year.

Emerging from the Pandemic

Some countries have emerged from the pandemic quicker than others. As I write this in New Zealand, we are definitely in the ‘others’ category, though the writing finally appears to be on the wall.

We have all felt the effects of lockdowns and largely not being able to travel as freely as we would otherwise prefer – or expect. Much of these limitations are due to government policies that have effectively scared a good chunk of the population into compliance.

While I could talk about the politics of fear, there are no shortages of people giving their view and the arguments are repetitive – I’m sure most of us have heard them.

The economics over the past 24 months are now more telling on what we ought to look out for as we emerge from this latest iteration of a new virus variant.

Bond rates

December 2021 marked the end of most western government stimulus into the economy to combat the effects of lockdowns. Unsurprisingly, when governments pay you to do nothing, you’re likely to do exactly that. The net effect of the end of these stimuli is that companies have started borrowing again.

Between the last quarter of 2021 to February 2022, junk bond rates went up by over 100 basis points, thus making it harder for companies to raise funds affordably. As a natural outcome of this we shall see greater pressure on equity prices so it’s not likely to be a great year for the stock market as a whole.

This year will certainly be the year for investors to seek yield investments that have outsized returns vis-a-vis the issuer’s risk profile. Digital assets will likely continue to face downward pressures in the short term as this asset class has traditionally been seen as a hedge against volatile equity prices, albeit not a great one considering its own volatility in general.

Inflation

It would be impossible to have this discussion about interest rates without taking into account inflation. This is probably where the politics of fear interject with the economics of fear.

The legacies of expansionary fiscal and monetary policies – not just over the last two years – but even 18 months prior to the pandemic – have set the resultant expectation that consumer spending will continue to increase.

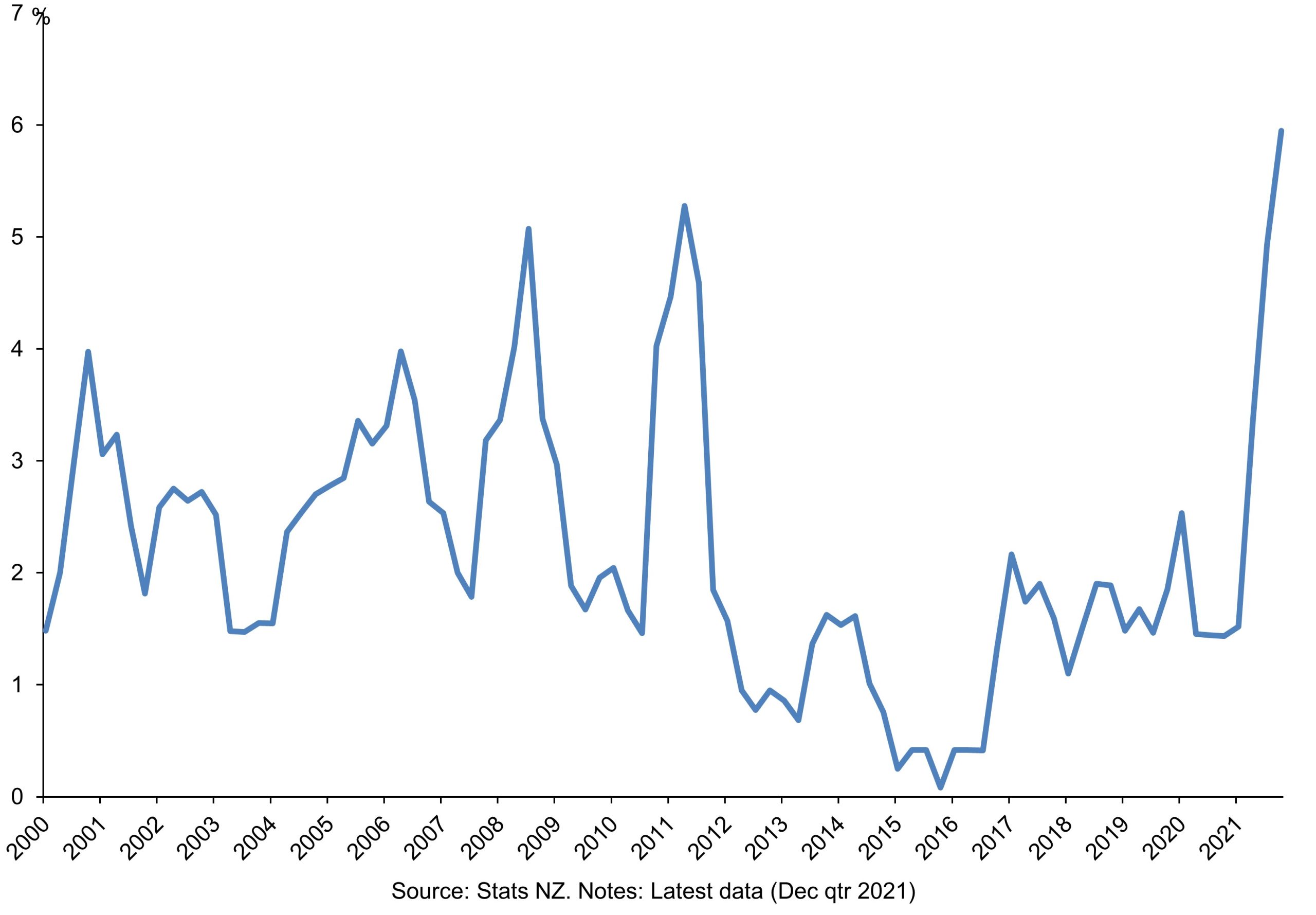

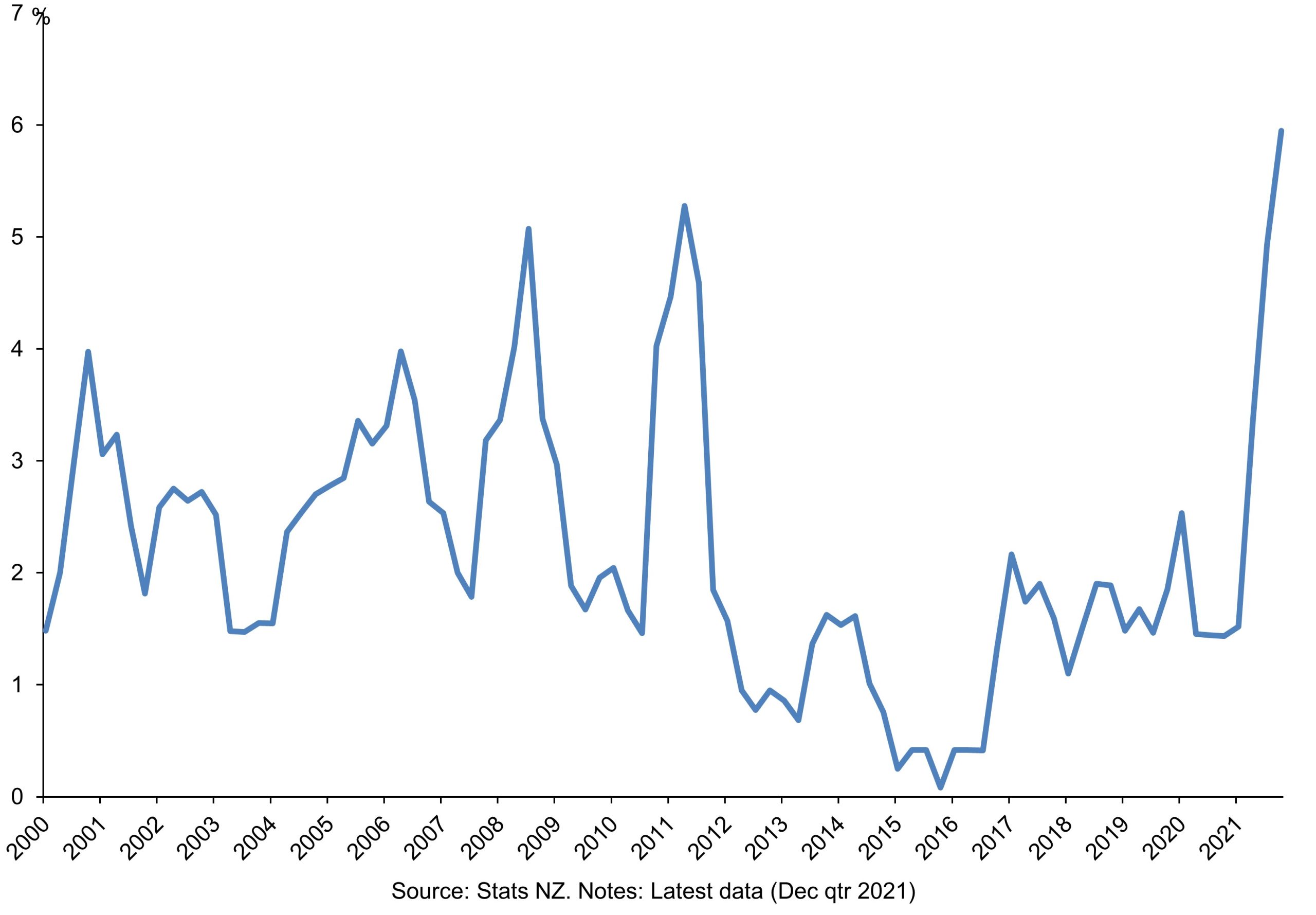

The net effect of this is increasing pressures causing further conundrums for central banks. In New Zealand, we are currently experiencing the highest rates of inflation in 30 years. The Reserve Bank Governors’ contract specifically calls for inflation to stay within 1% to 3%. This is on underlying inflation as opposed to headlined inflation.

This, of course, was all released during the ‘extraordinary’ events of battling the effects of lockdowns as a means of combatting the pandemic. It is worth noting that inflation rates are now at 6%, while it was only 2.5% in 2020.

The situation is even more dire in the US, making this more of a ‘Western’ phenomenon where interest rates have gone from the c 2.5% in early 2020 (before Covid became endemic), to a record breaking 7.5% last month.

Some forecasters believe inflation has reached its peak and will gradually fall this year. This may well be the case if inflationary pressures resulted purely from spending and particularly spending in the housing market.

What makes this cycle more unique is a confluence of other non-classical factors which have emerged largely due to the pandemic response.

Supply chain

Outside of factors like people spending less on overseas travel and more on cars and TVs, the supply chain problems run deeper than just cyclical demand. China’s (and by extension Hong Kong’s) continued application of a Covid Zero policy means that factories will continue to lockdown periodically, exacerbating supply chain issues even after most economies would have otherwise moved on to normalcy.

One cannot help but take a cynical view that the lockdowns probably help the Chinese government by distracting the population from their other economic and regional challenges.

Worker shortages

Many western economies are reliant on cost effective foreign labour across a spectrum of industries from manufacturing, agriculture and professional services. The fact remains that while many parts of the world are working in a post pandemic environment, international borders remain largely restricted. There is currently no free flow of talent.

Unsurprisingly, in combination with government stimulus initiatives, employees not only earn more but have more employment choices, and thus contribute classically to inflation.

Energy

We entered the pandemic with oil futures trading in the negatives. Two years later oil is trading in the $90 – $95 mark. By comparison in April 2020 it was $16.50.

In the midst of this, U.S. President Joe Biden “coincidentally” cancelled the Keystone pipeline and sent prices at pump spiraling to new heights.

How does this affect me?

Western governments have done little more than react to the pandemic by largely reducing civil liberties and providing stimulus payments to make up for those restrictions.

As a net result of such government interventions, the general populace is too distracted by Covid related restrictions to see that the vast majority of people are operating in a false economy that was created by largely ill planned and badly directed government aid.

Equally problematic, much of humanity has succumbed to our primal human emotion of fear. We fear foreigners who may be virus super spreaders, thus resulting in closed borders. Then, add the unvaccinated amongst us – deemed to be carriers of the plague. Anyone could kill us in the Covid world.

In countries like Canada, Australia and New Zealand, this has created a new underclass of people that are locked out of society due to their ‘irresponsible’ medical choice of potentially infecting innocent people. Never mind the fact that in New Zealand, a vaccine mandate is still in force for a nation that is already 95% fully vaccinated.

As politically motivated fears from Covid start to wane and as pressures mount on governments to do away with vaccine mandates, we are now seeing more troubling developments which only serve to continue distracting the populace.

The “sudden” crisis in Ukraine is a case in point.

Ukraine and Russia have been at war since 2014 when Russia took the Crimean Peninsula and established troops along Ukraine’s eastern border. Likewise, NATO has dangled the fruit of membership to Ukraine for years, after a succession of Central European countries joined the fold between 2004 and 2009.

Just as we are starting to feel safe to live more normal lives, Western and Eastern governments have leveraged the ongoing turmoil between Russia and Ukraine to invoke a new fear across the world – along with much volatility in the markets and higher fuel prices. Taking a giant step further, Russia is seizing an opportunity to make an even bolder move into Ukraine.

While I could go into more detail on the geopolitics of the region, it would suffice for this economic angle to agree that it is difficult to find a right position. It does however distract the people from what is truly occurring in their own countries and on a global macro initiative.

My take on industries that will do well

Finance

The cost of traditional financing is increasing but many entities who are eager to take on cash to expand their businesses are locked out of the market via government imposed rules that make the cost of financing both expensive and more onerous.

Yield products will continue to benefit from high interest rates as subprime commercial borrowers are locked out of cheap financing. As an example, the Crown High Yield Debt Fund, our curated investment product, underwrites Crown Capital’s commercial bridge financing arm. Investors in the Crown Debt Fund who are accustomed to 20% pa returns should anticipate a robust return going forward. This fund is available to accredited and wholesale investors (please click here for details).

Property

Property prices will start to mellow as the cost to borrow increases. Consequently, this is generally not a great time to invest in property. For those already in property however, rents are likely to continue rising.

Entertainment

With much of the world socially distancing, streaming services will continue to gain traction. Content creators such as movie producers will find ready buyers for half decent content.

Obris investors may expect to capitalize on this trend when 0600, the VFX thriller we are underwriting is released next year. We wrote about the 0600 investment in the Global Investor last year. Feel free to read it again by clicking here.

Energy

Prices for fossil fuels will continue to rise. Most petroleum companies’ share prices are still depressed compared to pre-pandemic levels. It is worth noting that while their fundamentals support a buy recommendation in the long term, in the short term, energy companies are at the mercy of supply chain disruptions, much like every other sector.

Equities

With rising bond rates, equities as a whole will continue to endure downward pressure. Unless you have a medium-to-long term investment horizon, interest yielding assets will be a better short term investment.

Digital Assets

While the outlook for digital assets will likely remain bearish until at least the second half of this year, it is worth noting that defi will likely be making a resurgence this year and opportunities to develop this asset class are likely to push it into the mainstream.

While the industry is still fragmented, mature regulated funds in this area will reduce the complexity for investors and attempt to create outsized returns from this volatile asset.

In summary

More opportunities will emerge as we move further into a post-pandemic yet equally frenetic and unstable world, particularly for savvy investors who have access to asymmetric investment opportunities and the knowledge to discern which investments to pursue.

What better time than now to hone your investment knowledge and access to Obris’ bespoke offerings than by joining a group of like minded investors with proven successes. Please respond to this email if you would like to learn more about what Obris has to offer you.

Sincerely,

Marvin, On behalf of the Obris Team